How to open a company in the USA

29 December, 2022

The United States is the number 1 economy in the world measured by GDP and the second largest exporter in the world after China. That is why it is essential to open a business in the US.

In the USA the entrepreneurial and innovative world is strong and those who dare to go further are well regarded, in addition there are great facilities to access credit, all this makes the country a mecca for those who want to succeed in business.

Another advantage to open a company in the United States is that the procedures are faster and easier than you think.

Can a foreigner create a company in the USA?

Yes, it is not necessary to be a resident or citizen to create a company in the USA. Americans understand the importance of being flexible to do business, that is why they have different judicial models so that different types of companies can be created with very few requirements, both legal and capital.

Let’s see what are the steps to open a company in the United States.

Steps to register a company in the United States

1) Choose the name

You must choose a name that identifies the company and that is available to be registered as a trademark. For that, you can make a query in the database of the United States Patent and Trademark Office (USPTO).

It is also advisable to look for one that is available for use as a domain name on the Internet, for that you can consult Namecheap or GoDaddy.

2) Legal structure of the company

In order to choose the most appropriate model, several factors must be taken into account, such as the number of partners, the amount of capital invested, the industry in which the

company will operate, etc. This is one of the most complex points and where it is highly recommended to seek an expert advisor in creating companies in the USA.

The main company structures in the USA are:

- Sole Proprietorship: The advantages and disadvantages of this model are the same as in other countries. The requirements and formalities to open this type of business are simpler and less expensive than to open a corporation.

The danger is that in the event of economic or legal problems, the owner has unlimited liability, i.e., he must respond with his own assets.

b) Corporation: In this case the shareholders have limited liability, only up to the amount they have invested in the company.

In turn, within corporations, there are two types of companies. Corporation S is the one used when the corporation will have only one owner and Corporation C when there are several capitalists.

Opening a corporation in the USA has the disadvantage of double taxation, since taxes must be paid for the company and then each investor must pay taxes individually.

However, there are accounting strategies that reduce the amounts to be taxed, so this issue is not seen as something too negative by businessmen.

- Limited Liability Company: Known as LLC, it is the most common form of business used by foreigners who want to open a business in the USA. LLCs are a combination of corporations and limited partnerships.

An LLC may have a single owner or several investors, and each of the members is not personally liable for the obligations incurred by the company.

In this case, the company’s profits are transferred to its members, who incorporate such income into their own personal income when filing their individual tax returns.

- Partnerships: To open a Partnership in the USA, the company must have two or more persons or entities that own and manage the company. The partners share the profits, as well as the losses and the responsibility of the management. And taxes are the individual responsibility of each of the partners.

Depending on the type of corporation you choose, the name of your U.S. company must end in “Corporation“, “Limited“, “Incorporated“, or an abbreviation related to the above words.

The Division of Corporations in the state where you want to register may reject a name if it believes it may be confusing or harmful. In addition, some names cannot be used without regulatory review, such as names that include terms like Bank or Trust.

3) Physical address of the company

In order to open an LLC or a Corporation in the United States it is necessary to have a physical business address.

In addition, if you want to create a company in the United States, the company must have a Registered Agent, who must also have a local address. The Registered Agent is the official contact for the company to receive legal documents and notices.

Since many companies start the procedures without having their own office, they usually hire the services of Business Centers, where the business address can be registered.

Another option is to hire a virtual business address.

A U.S. telephone number is also a requirement. There are companies that will provide you with both a virtual business address and a telephone number. They can even reserve a free number, known as a “toll-free” number, which helps you to generate a large company image in front of the customers who call you.

4) Open a bank account

This step was complicated until recently, but with the new fintech has become more flexible and it is now possible to open bank accounts from anywhere in the world.

The requirements of the banks may vary, but normally what they all ask for are the following documents:

- Proof of identity, this can be your driver’s license or passport.

- Certificate of Incorporation

- The company’s EIN, or Tax ID

- U.S. mailing address

5) Application for incorporation

Once the company has chosen its name and corporate structure, and has a physical address, it can file the Certificate of Incorporation application with the Department of State, or with the Division of Corporations of the state where it wants to locate.

In addition to the above mentioned data, the form must include the name and address of the Registered Agent, amount and par value of the shares to be issued by the company and the names of each of the members and officers.

After the form is filed, the incorporation application fee must be paid. If the Corporations Division accepts the application, you will be notified of the incorporation.

Once accepted, to maintain good standing, annual accounting and tax reports and franchise tax payments must be filed.

6) Taxes

You must have identification for the IRS (Internal Revenue Service). That identification is your Tax ID, also known as a Federal Employer Identification Number (FEIN), which is the same as the EIN.

This is the number you will be asked for by banks and other entities to carry out any procedure.

You will also need to have a social security number, if you are a resident, or an ITIN which is the Personal Taxpayer Identification Number.

That’s all the data you’ll need to be able to hire staff and comply with IRS requirements.

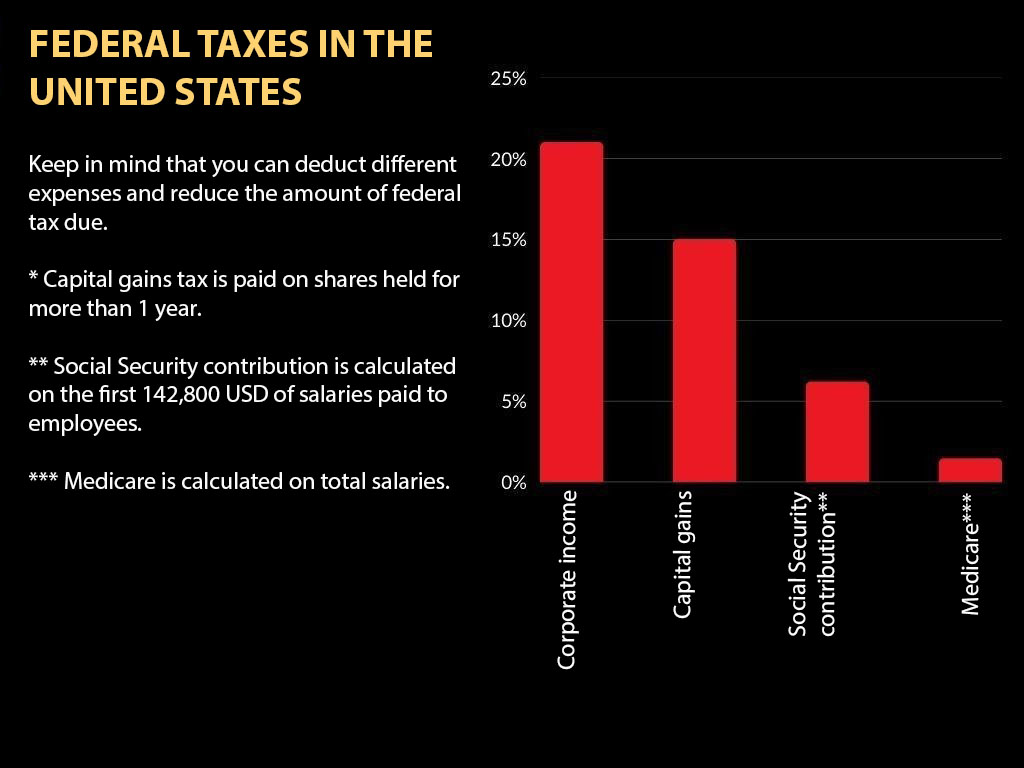

When opening a corporation in the USA you have to pay a federal tax and state taxes, which will vary depending on the state where you decide to establish the corporation. In addition, some local governments charge income taxes.

Sole proprietorships, partnerships and LLCs do not have to pay corporate taxes. But remember that their owners must file a self-employment tax return.

The federal rates in this case are 15.3% on income earned.

On the other hand, corporations pay a 21% federal tax rate on their income.

In addition, states levy state taxes ranging from 3% to 12%. There are some exceptions where there are no state corporate taxes, such as Nevada, Texas, Ohio, South Dakota, Washington and Wyoming.

Self-employed individuals must file Form 1040 annually and corporations must file Form 1120. In both cases, the filing of the forms can be done online at the IRS website.

7) Registered accountant

To comply with your tax obligations you will need to hire a CPA. Certified Public Accountants (CPA) are in charge of preparing and filing annual tax returns. They also advise you on the most convenient tax strategies.

8) Specific licenses

Depending on the type of business your company is engaged in, you will need to apply for a business license from the corresponding agency.

It will not be the same license, and therefore the same requirements, if you want to open an LLC in the USA that is dedicated to food manufacturing as it is to create a corporation in the USA that has casinos or a Sole Proprietorship to manage a restaurant.

The requirements may also vary from one state to another. That is why it is advisable to hire legal advisors who have experience in the specific field in which you want to invest.

9) Visas and immigration

Although it is possible to open a company in the United States and manage it from abroad, it is necessary to project future needs and think about whether it will be necessary for some or all of the owners to settle in the country at some point.

If so, the different visa options offered by the U.S. for those who want to immigrate as investors should be studied.

The most popular option is the E-2 investor visa, also known as the entrepreneur visa. There is no minimum investment amount to obtain this visa, but it is understood that the capital invested must be sufficient to open a company in the U.S. and for that company to be successfully managed. In addition, there must be a business plan that proves the viability of the company.

Other important questions to ask before starting a business in the U.S.

Which state should I choose to open the company in the USA?

If you are a U.S. resident, you will want to open the company in the state where you normally do business.

Otherwise, you should study which states have the greatest facilities to create a company in the USA and which have the lowest taxes. Some of the most favorable states for doing business in the USA are Florida, Delaware, Nevada and Wisconsin.

Is it necessary to have a lawyer?

It is not mandatory. Most of the procedures can be done in person.

Of course, if you do not know the federal and state laws about the industry in which you plan to invest, it is in your best interest to hire an experienced advisor, as this will save you time, money and stress in the long run.

If I open the company in one state, can I do business in others?

Yes, you can. But you will have to do more paperwork.

In the state where you registered the company, it will be considered as a local company, while in the other states where you want to operate it will have the qualification of foreign corporation and you will have to file an application to be able to operate in those other states

where you intend to expand. The procedure to operate in other states is known as “Foreign Qualification“.

How long does the incorporation process take?

In most states the process usually takes between 4 and 6 weeks. In many states there is the option of expedited processing, which takes about 10 days.

How can we help you?

At Ltd24ore we are dedicated to assisting our clients in setting up international companies. Throughout our 9 years of history we have helped hundreds of clients to create their companies in the United Kingdom, Portugal, Spain, Italy, Canada and the United States.

In the US, we work in the states of Delaware and Wyoming, two of the states with the lowest tax costs and the easiest way to start a business in the US.

If you need help or information to create a company in the USA you can contact our advisors, who speak your language.

Our Borderless Company service, in addition to helping you with the opening of your company, includes:

- Ongoing tax advice.

- Consulting to avoid double taxation.

- Access to the Compañías Sin Fronteras community and its exclusive Facebook group.

- Participation in the annual meeting of Companies Without Borders.

We are familiar with U.S. federal law and are also experts in Delaware and Wyoming corporate and tax law.

These are the advantages of setting up a company in the United States with ltd24ore:

- Online incorporation without the need of a notary.

- Reduced opening costs.

- Online tax management, bookkeeping and accounting services.

- Preparation of the company’s accounts and filing of tax returns with the American tax authorities.

- Free access to accounting software based on artificial intelligence.

- Personal assistance and advice via chat, e-mail and telephone.

- Consulting with tax advisors who are experts in U.S. legislation.

We seek to create and maintain long term relationships with our clients, that is why for us it is fundamental that you can trust us and that you receive an excellent quality service, and

that is what we try to give you on a daily basis from the moment you open your business in the USA.

If you have any questions, you can write to our advisors or call us, and we will know how to help you.

Leave a Reply